On the Hill

There are about 15 weeks of floor time in the Senate before the election (and before the next funding deadline), which creates both an opportunity and tough decisions for Senate Majority Leader Chuck Schumer. He can pursue nominees, particularly judges, with a simple majority try to move bipartisan bills which his incumbents are eager to pass ahead of the election.

The Senate trial for DHS Secretary Alejandro Mayorkas — even if quickly dismissed — will take up a couple of days in April. And funding the government will eat up some of the end of September. There’s also a few “magic Mondays” here and there where the Senate is out.

Door No. 1: Normally, confirming lifetime judges would be simpler, but Sen. Joe Manchin’s (D-W.Va.) personal filibuster against any party- line judges means Schumer has to run the table in his 51-member caucus to push through anyone who lacks Republican support. Now, that doesn’t happen that often: 87 percent of President Joe Biden’s lifetime judicial nominees have received bipartisan support on the floor, according to a Democratic aide.

Door No. 2: Schumer’s members are clamoring for bills that would overhaul rail safety, legalize cannabis banking, and claw back money from failed bank executives, as well as a farm bill and an FAA bill. There’s also pressure to crack down on TikTok, and plenty of Democrats want more votes on the failed border security deal. There’s also now a bridge to build in Baltimore.

Meanwhile, a bipartisan tax agreement is in real trouble, with Senate Republicans feeling snubbed after being left out of the deal between Senate Democrats and the House GOP.

Finishing any of those bills will take up a decent amount of floor time.

With all of this happening in the background, Lobbyit has been busy working on the Hill to ensure NEA’s policy priorities are positioned for this key stretch on the Hill. Last month we met with:

- Maggie Hassan (D-NH): Senate Finance Subcommittee on Health Care; Senate Health, Education, Labor and Pensions Subcommittee on Primary Health and Retirement Security;

- Michael Burgess (R-TX): House Budget Committee Health Care Task Force, Chair; House Energy and Commerce Subcommittee on Health

- Judy Chu (D-CA): House Ways and Means Committee Health Subcommittee

- Tracey Mann (R-KS): Congressional Bipartisan Rural Health Caucus; Congressional Primary Care Caucus; Congressional Telehealth Caucus

- Lou Correa (D-CA): Congressional Primary Care Caucus

Green Book Previews Biden Administration’s Opening Offer in 2025 Tax Reform Debate

On March 11, 2024, the Treasury Department released the General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals, known as the Green Book. The Green Book details the nearly $5 trillion in individual and corporate tax hikes that President Biden has called for in his FY 2025 budget. In addition to reaffirming previous proposals, including raising the corporate income tax rate and imposing a minimum tax on wealthy households, the 2025 Green Book includes new proposals to increase the corporate alternative minimum tax (CAMT) rate and eliminate business deductions for excess employee compensation.

Because Republicans control the House of Representatives, no action on the Green Book proposals is currently expected. That said, because the proposals would serve as a starting point for future tax reform negotiations with Democrats, they are worth understanding better. Moreover, with parts of the Tax Cuts and Jobs Act (TCJA) set to expire at the end of 2025, Republicans may have to accept tax increases to preserve current-law benefits for families and small businesses. This means that many of the proposed revenue raisers, particularly the increased corporate rate, can no longer be dismissed as merely aspirational.

Business Tax Proposals

The President’s FY 2025 budget proposes to increase business taxes by more than $2.7 trillion over the next 10 years. The bulk of this revenue would come from corporate and international tax increases, including proposals to:

- Increase the top federal corporate tax rate to 28%.

- Raise the CAMT rate to 21%.

- Quadruple the excise tax rate on corporate stock repurchases (from 1% to 4%).

- Disallow corporate deductions for any employee compensation exceeding $1

Reform international taxation by:

- Increasing the global intangible low-taxed income

- Adopting the undertaxed profits

- Repealing the foreign-derived intangible income

Other business tax proposals in the FY 2025 budget include:

- Making permanent the excess business loss limitation for noncorporate taxpayers.

- Repealing deferral of gain from exchanges of like-kind real

- Increasing taxes on oil and gas, including eliminating the expensing of intangible drilling costs and the use of percentage depletion for oil and gas wells.

- Extending the wash sale and other tax rules to digital

- Making permanent the new markets tax

Bills by Issue

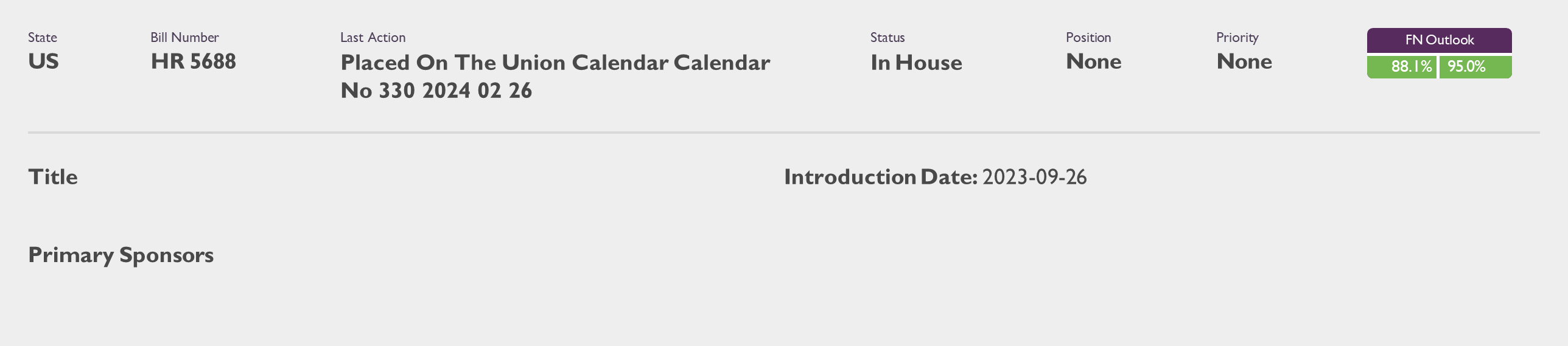

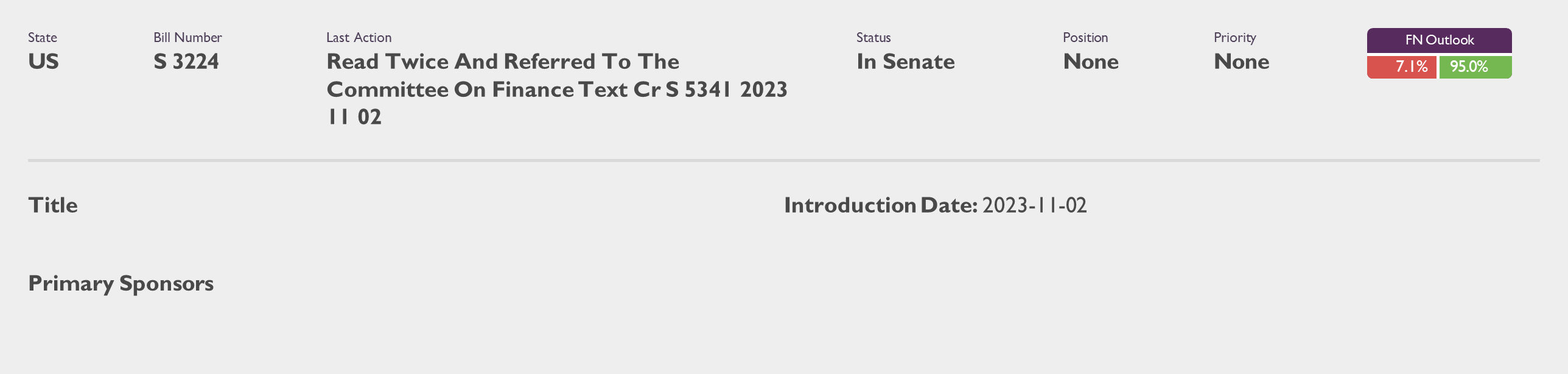

National Employers Association (8)