Work on the Hill

On Capitol Hill, October proved to be a relatively uneventful month as Congress continues its long recess until November 12, 2024. With legislative business paused, some committees have remained active, but the overall pace of action has slowed.

Despite the lull in congressional activity, Capitol Hill staffers are diligently preparing for the upcoming 119th Congress. Given the ongoing preparations for the next Congress, it is crucial to maintain our engagement with Capitol Hill to ensure our priorities remain at the forefront of its agenda. With the 2024 elections rapidly approaching, the 119th Congress’s agenda will significantly shift depending on the election’s outcome. Lobbyit is well-positioned to navigate the uncertain political landscape and continue engagement with lawmakers from both parties to ensure our priorities are reflected in the next legislative agenda.

Lobbyit will continue to monitor legislative developments closely and work with lawmakers to keep NEA at the forefront of the healthcare discussion through the end of this Congress and into the next.

Lobbyit also shared a report from the Department of Treasury on Affordable Care Act Marketplace Coverage for the Self-Employed and Small Business Owners. It details some of the spending on ACA Marketplace plans and provides data on numbers of people insured in different states.

In October, Lobbyit met with the Senate HELP Health Subcommittee to get a better insight into moving legislation for the lame duck period into the 119th Congress. For the lame duck period, telehealth, PBM reform, and program reauthorization bills ae the most likely to move forward, while committee staff would like to see more progress on the Physician Fee Schedule, prior auth reform, and mental health services. For the 119th Congress, committee staff are already planning a larger healthcare package including site neutral payments, additional telehealth measures, Medicare Advantage and Medicaid reform, 340B updates, mental health access, and more.

Regulatory Update

Enhancing Coverage of Preventive Services Under the Affordable Care Act

Summary: This document sets forth proposed rules that would amend the regulations regarding coverage of certain preventive services under the Public Health Service Act. Specifically, this document proposes rules that would provide that medical management techniques used by non-grandfathered group health plans and health insurance issuers offering non-grandfathered group or individual health insurance coverage with respect to such preventive services would not be considered reasonable unless the plan or issuer provides an easily accessible, transparent, and sufficiently expedient exceptions process that would allow an individual to receive coverage without cost sharing for the preventive service that is medically necessary with respect to the individual, as determined by the individual’s attending provider, even if such service is not generally covered under the plan or coverage. These proposed rules also contain separate requirements that would apply to coverage of contraceptive items that are preventive services under the Public Health Service Act. Specifically, these proposed rules would require plans and issuers to cover certain recommended over-the-counter contraceptive items without requiring a prescription and without imposing cost-sharing requirements.

In addition, the proposed rules would require plans and issuers to cover certain recommended contraceptive items that are drugs and drug-led combination products without imposing cost-sharing requirements, unless a therapeutic equivalent of the drug or drug-led combination product is covered without cost sharing. Finally, this document proposes to require a disclosure pertaining to coverage and cost-sharing requirements for over-the-counter contraceptive items in plans’ and issuers’ Transparency in Coverage internet-based self-service tools or, if requested by the individual, on paper. These proposed rules would not modify Federal conscience protections related to contraceptive coverage for employers, plans and issuers.

Agency: IRS, Treasury; Employee Benefits Security Administration, DOL; CMS, HHS

Action: Proposed rule

Dates: To be assured consideration, comments must be received at one of the addresses provided below by December 27, 2024.

Continuing Resolution Signed: Deadline Dec 20

The U.S. Senate passed a 12-week spending bill with a 78-18 vote, avoiding a potential government shutdown before the Sept. 30 deadline. The bill was then signed into law by President Biden. It temporarily extends current government spending levels until Dec. 20, allowing lawmakers to return home and campaign before the November elections. After the elections, they will have around five weeks to negotiate a full-year fiscal 2025 spending deal.

The bipartisan bill, described as a “straightforward compromise” by Senate Appropriations Chair Patty Murray, received broad support despite some opposition from GOP conservatives who wanted lower spending levels and voter ID measures. Senate Majority Leader Chuck Schumer praised the bill for keeping the government open and avoiding a shutdown.

Key issues, including disaster aid and veterans’ healthcare funding, were left unresolved and will be addressed in December. The bill also allocates $231 million for Secret Service protection and $20 billion for FEMA disaster relief.

False Claims Act Ruling

A recent federal court ruling could impact how the False Claims Act (FCA) is used to combat fraud in Medicare and Medicaid, particularly the role of whistleblowers. U.S. District Judge Kathryn Mizelle ruled that the FCA’s whistleblower provisions are unconstitutional, a decision that may lead to the reduction of whistleblower power in such cases if upheld. While this ruling only applies to the specific case, it could set a legal precedent.

Experts predict the case will likely reach the Supreme Court, where conservative justices may take interest in the issue. Whistleblower-driven cases generate billions for the U.S. each year, and legal analysts argue that weakening these provisions could reduce the number of fraud cases brought forward. Critics of the ruling, including whistleblower attorney Gordon Schnell, argue that the decision misunderstands the FCA, noting that the Justice Department retains ultimate control over these cases. Even if the Supreme Court finds the FCA unconstitutional, Schnell expects Congress or the DOJ to act swiftly to protect whistleblower powers.

FTC Sues Three Largest Drug Middleman for Allegedly Inflating Insulin Prices

The Federal Trade Commission (FTC) filed a lawsuit on Friday alleging “anticompetitive” behavior that has driven up insulin prices against the three biggest pharmacy benefit managers (PBMs): UnitedHealth’s OptumRx, Cigna’s Express Scripts, and CVS Caremark Rx. In the US, these businesses oversee almost 80% of prescription drugs. Despite the availability of less expensive options, the FTC claims that they established a discount program that benefits manufacturers who charge higher prices for insulin, increasing patient expenses. PBMs and partners are allegedly able to make money from people who depend on insulin thanks to this process.

The lawsuit is part of a broader scrutiny by the Biden administration aimed at uncovering the questionable practices of PBMs in the pharmaceutical distribution system. The FTC highlighted concerns that powerful PBMs have contributed to increasing insulin costs over the past decade. In response, the targeted companies strongly criticized the FTC’s claims, arguing that the agency misunderstands the drug pricing environment and that they have made efforts to make insulin more affordable.

Although the FTC admits that PBMs have contributed to the increase in insulin pricing, it also identified medication producers such as Eli Lilly, Novo Nordisk, and Sanofi as important actors. The FDA said that as part of its ongoing inquiry into the increasing price of life-saving medications, it could pursue additional legal action against drug producers in the future.

Lame-Duck ‘Must Pass’ Bills

Appropriations / Continuing Resolution. If Congress passes a short-term CR to extend discretionary program funding into December, it must then decide how to act on the 12 regular appropriations bills to fund the government through Sept. 30, 2025, which is the end of the next fiscal year. The outcome of the November elections may impact whether Congress decides to pass full-year legislation or simply pass another CR that extends into 2025 (and the next Administration). In 2023, Congress passed these bills in two packages, with each combining six of the bills. The first package included Agriculture, Commerce-Justice-State, Energy-Water, Interior, Military Construction-VA, and Transportation-HUD. The second package included Defense, Financial Services, Homeland Security, Labor-HHS-Education, Legislative Branch, and State-Foreign Operations. Passage of the bills in this format required bipartisan majorities. Congress may be forced to try a similar approach in December.

Health Care Extenders. In March, the Continuing Appropriations Act (H.R. 4366) extended several expiring health care programs through Dec. 31, including funding for Community Health Centers, National Health Service Corps, Teaching Health Centers with Graduate Medical Education, and Special Diabetes programs. It also delayed scheduled cuts for “disproportionate share” hospitals. These provisions are likely to be extended again.

Bills by Issue

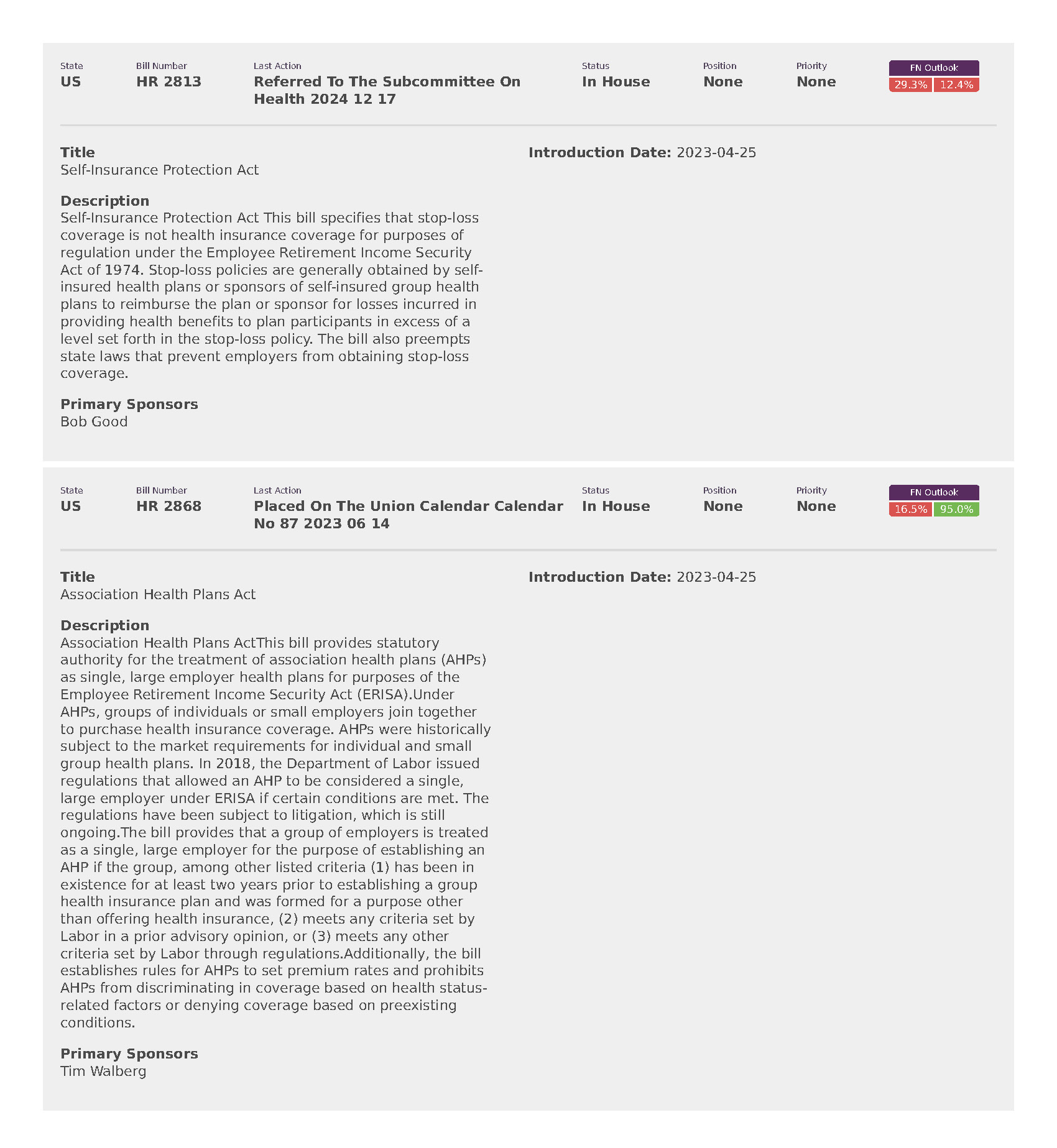

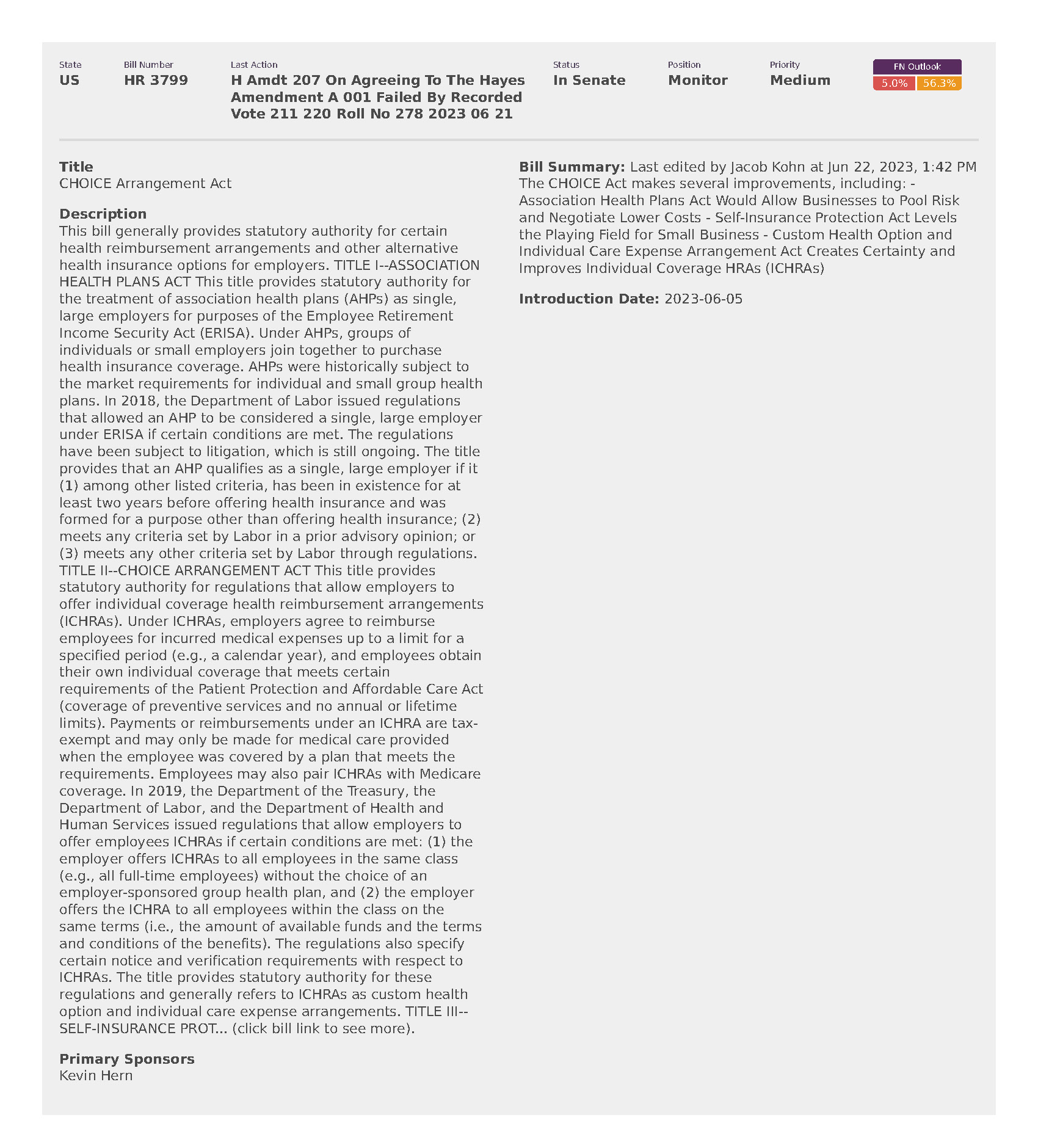

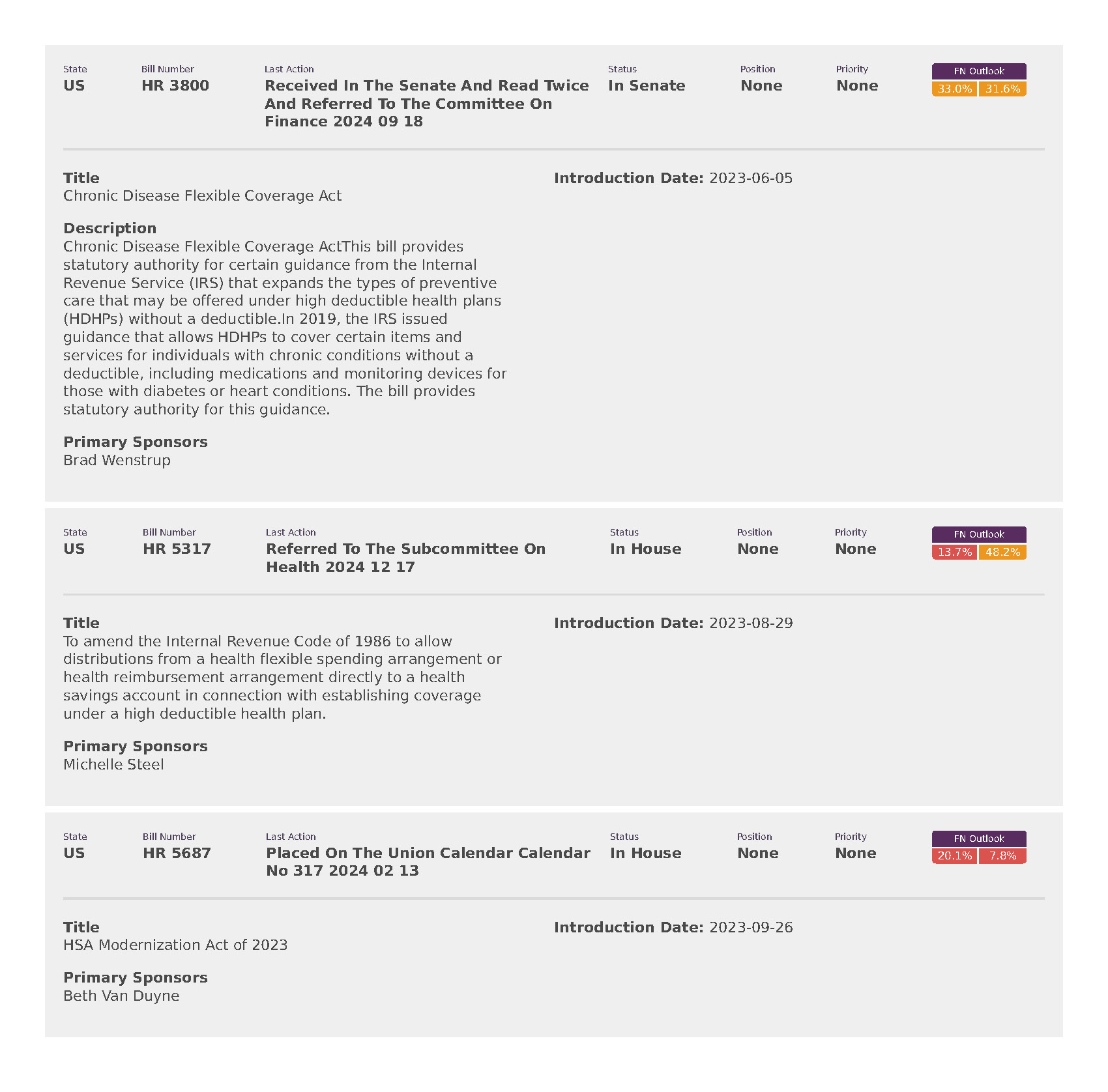

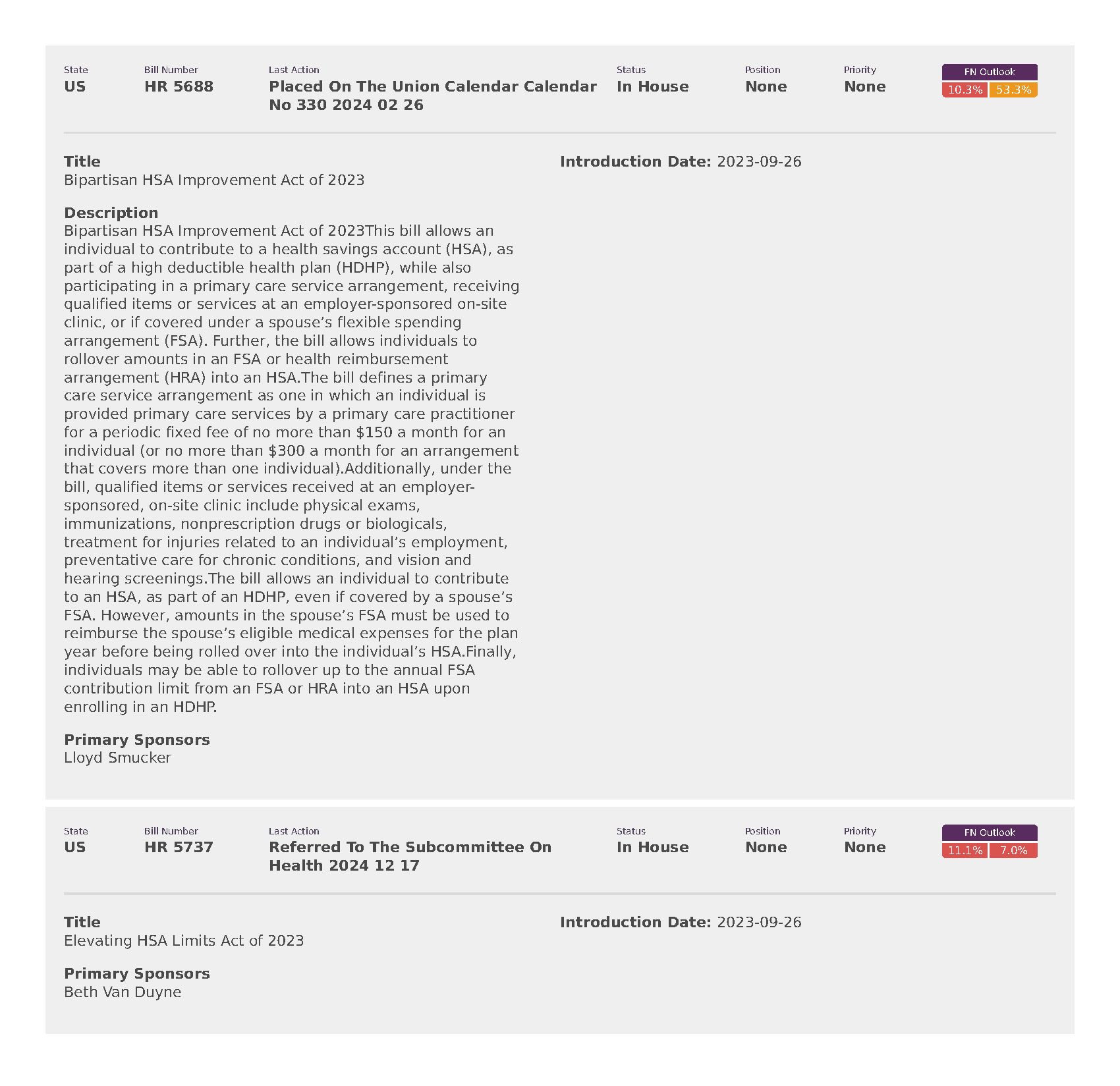

National Employers Association (8)