April on the Hill

Congress took a few weeks off in April after the March budget sprint, returning from April 8 – 19. With 2024 funding for the federal government wrapped up, upon its return, Congress turned its attention to the myriad items that have stacked up on its to-do list. This includes authorizing funds to rebuild Baltimore’s Francis Scott Key Bridge and provide military aid to Ukraine and Israel. Additionally, Congress began work on a business-supported tax bill, social media legislation, the reauthorization of a post–9/11 provision of the Foreign Intelligence Surveillance Act, and the reauthorization of the Federal Aviation Administration, among other matters.

Finally, Congress used Congressional Review Act resolutions to oppose the National Labor Relations Board’s joint-employer rule and the U.S. Department of Labor’s independent contractor rule.

Congress also began work on FY25 Appropriations at the end of April. On the House side, Budget hearings included appearances by Treasury Secretary Janet Yellen, Transportation Secretary Pete Buttigieg, and Labor Secretary Julie Su. Senate budget hearings included Transportation Secretary Buttigieg, Interior Secretary Deb Haaland, and Environmental Protection Agency Administrator Michael Regan.

The Senate Finance Committee held a hearing on health cybersecurity and the recent attack on Change Healthcare, with UnitedHealth Group CEO Andrew Witty. This follows a House hearing on the topic earlier in April, with more congressional action expected to come.

Lobbyit’s work this month on your behalf:

Lobbyit is scheduling meetings for NEA to discuss the need for health plans’ flexibility and continuation of the Trump-era waivers. May 9 – Rep. Greg Stanton

FTC Bans Non-Competes

On April 24, the Federal Trade Commission voted 3-2 to finalize its Non-Compete Clause Rule, which effectively prohibits the use of non- compete provisions. The rule fulfills—at least for the time being—a 2020 campaign promise that then-presidential candidate Joe Biden made to “eliminate all non-compete agreements.” The sweeping rule contains an expansive definition of non-compete agreements, which includes other contractual arrangements such as certain nondisclosure and training repayment agreements. The rule also applies retroactively by invalidating non-compete contracts that have already been negotiated and bargained over. If this sounds a lot like contract law, you’re spot on. As contractual agreements, non-competes have traditionally fallen under the purview of state contract law. This is part of why the employer community is so concerned with the FTC’s action. Already, multiple legal challenges have been filed challenging the regulation.

IRS Warns Companies are Making False Statements About Health Plan Reimbursements

In IR-2024-65 (the “IR”), the IRS warns taxpayers that some companies are misrepresenting the circumstances under which food and wellness expenses can be paid or reimbursed under health flexible spending arrangements (“health FSA”), health savings accounts, health reimbursement arrangements and medical savings accounts.

Background. To be tax-deductible under Internal Revenue Code (“Code”) Section 213(a), or subject to tax-exempt reimbursement, the cost of an item or service generally must meet the definition of “medical care” expenses under Code Section 213(d). This section defines medical expenses as amounts paid for the diagnosis, cure, mitigation, treatment or prevention of disease, or for the purpose of affecting a structure or function of the body. An expense may qualify only if it is “ primarily” for the prevention or alleviation of a physical or mental defect or illness, and only if the expense would not have been incurred but for the disease or condition.

IR-2024-65. In the IR, IRS Commissioner Danny Werfel says that, “taxpayers should be careful to follow the rules amid some aggressive marketing that suggests personal expenditures on things like food for weight loss qualify for reimbursement when they don’t qualify as medical expenses.”

The IR goes on to say that, “some companies mistakenly claim that notes from doctors based merely on self-reported health information can convert non-medical food, wellness and exercise expenses into medical expenses, but this documentation actually doesn’t. Such a note would not establish that an otherwise personal expense satisfies the requirement that it be related to a targeted diagnosis-specific activity or treatment; these types of personal expenses do not qualify as medical expenses.”

As an example of the problem, the IR discusses a diabetic who is attempting to control his blood sugar by eating foods that are lower in carbohydrates. He sees an advertisement from a company stating that he can use pre-tax dollars from his health flexible spending arrangement (“health FSA”) to purchase healthy food. He contacts the company, which tells him that, for a fee, the company will provide him with a doctor’s note that he can submit to his health FSA to be reimbursed for the cost of food purchased.

Ominously, the IR goes on to state that, “FSAs and other health spending plans that pay for, or reimburse, non-medical expenses are not qualified plans. If the plan is not qualified, all payments made to taxpayers under the plan, even reimbursements for actual medical expenses, are includible in income.”

Immigration News

The confluence of two recent U.S. Citizenship and Immigration Services (USCIS) final regulations—the H-1B modernization rule and the new fee schedule—contributed to a busy week as far as immigration policy goes:

-

- H-1B cap After extending the fiscal year (FY) 2025 H-1B registration period, USCIS has announced that it “has received enough electronic registrations for unique beneficiaries” to meet the FY 2025 cap for H-1B visas. According to the announcement, pursuant to a random selection process, USCIS has “notified all prospective petitioners with selected beneficiaries that they are eligible to file an H-1B cap-subject petition for such beneficiaries.” USCIS began accepting petitions on April 1, 2024.

- New fee schedule in USCIS was quick to remind filers that their petitions are subject to the new fee schedule that USCIS adopted on January 31, 2024. This new rule schedule went into effect on April 1, 2024, after a federal judge denied a legal challenge to enjoin the rule. According to USCIS, “Petitions postmarked on or after April 1, 2024, must include the new fees or [USCIS] will not accept them.”

- Work authorization On April 4, USCIS announced the issuance of a temporary final rule to “increase the automatic extension period for certain employment authorization documents (EADs) from up to 180 days to up to 540 days.” According to the news release, the rule “will prevent already work-authorized noncitizens from having their employment authorization and documentation lapse while waiting for USCIS to adjudicate their pending EAD renewal applications and better ensure continuity of operations for U.S. employers.” The rule applies to “(1) applicants who timely and properly filed their Form I-765 applications on or after Oct. 27, 2023, if the application is still pending on April 8, 2024; and (2) applicants who timely and properly file their Form I-765 application on or after April 8, 2024 and on or before Sept. 30, 2025.”

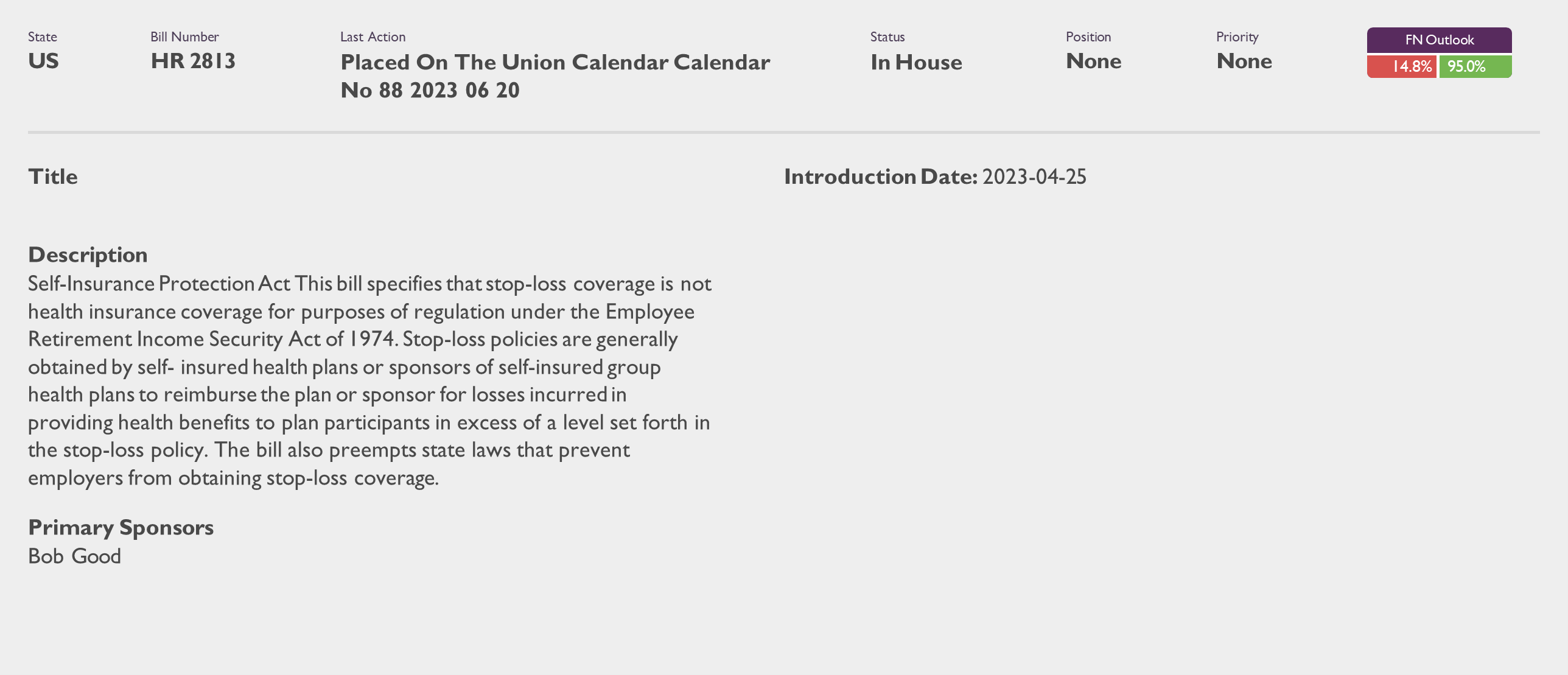

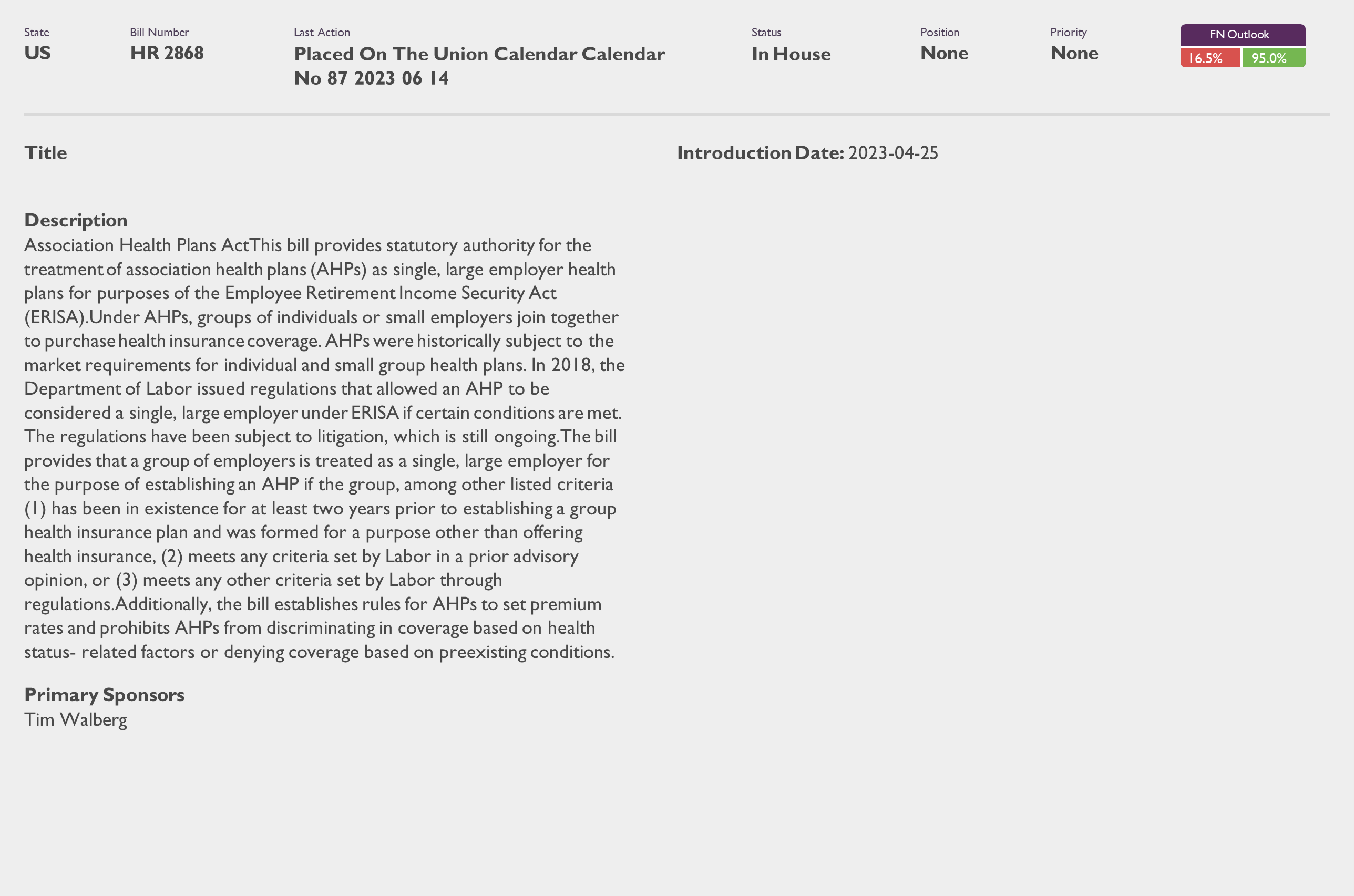

DOL Proposes Rescission of 2018 Regulations Affecting Association Health Plans

The U.S. Department of Labor (DOL)’s Employee Benefits Security Administration (EBSA) has issued a Notice of Proposed Rulemaking that would rescind a 2018 DOL rule entitled “Definition of Employee – Association Health Plans,” or the 2018 AHP Rule. The purpose of the rule was to expand the availability of AHPs.

Before the 2018 AHP rule, a multiple employer welfare arrangement (MEWA) typically constituted a single ERISA plan only if it was established by a “bona fide” association of employers. An association was “bona fide” only if it had a genuine organization relationship and the ability to control the association. Qualifying as a MEWA was beneficial for some individual and small group health insurance plans to avoid some Affordable Care Act (ACA) reforms.

The 2018 AHP rule redefined when an AHP could be treated as a single ERISA plan by creating a more flexible “commonality of interest” test instead of the traditional bona fide association test. As a result, working owners without common-law employees could participate in an AHP under the rule.

However, in 2019, a federal district court invalidated key portions of the 2018 AHP rule, including the “commonality of interest” test and the working owner provisions. The DOL later issued additional AHP guidance, but the status of AHPs remained unclear.

According to the DOL, the proposed rule aims to resolve the current uncertainty regarding the status of AHPs. In an accompanying news release, the DOL stated that rescinding the 2018 AHP rule would allow for a reexamination of the criteria for a group or association to constitute an AHP and to ensure that federal guidance aligns with the plain language and purposes of ERISA.

Bills by Issue

National Employers Association (8)