Work on the Hill

August brought a mix of progress and gridlock to Capitol Hill as lawmakers juggled the FY25 appropriations process with district work periods. On July 24, 2024, the House passed the Interior, Environment, and Related Agencies Appropriations Act for FY 2025. The Senate remains deadlocked over contentious issues, casting a shadow over the timely passage of all 12 appropriations bills.

The healthcare landscape saw mixed developments. On August 1, 2024, the Centers for Medicare & Medicaid Services (CMS) issued a final rule updating Medicare payments and policies for inpatient hospitals and long-term care hospitals. The rule aims to improve the health of people with Medicare by addressing key social determinants of health and strengthening emergency preparedness. However, on July 10, 2024, CMS announced in final rulemaking that average payment rates under the PFS are proposed to be reduced by 2.93% in CY 2025 compared to the average amount these services will be paid for most of CY 2024.

As August recess begins, the focus shifts back to Capitol Hill, where lawmakers will have to reconcile their differences on spending and healthcare priorities in the coming weeks and months. Lobbyit looks forward to continuing our advocacy of NEA’s priorities as the September work period quickly approaches.

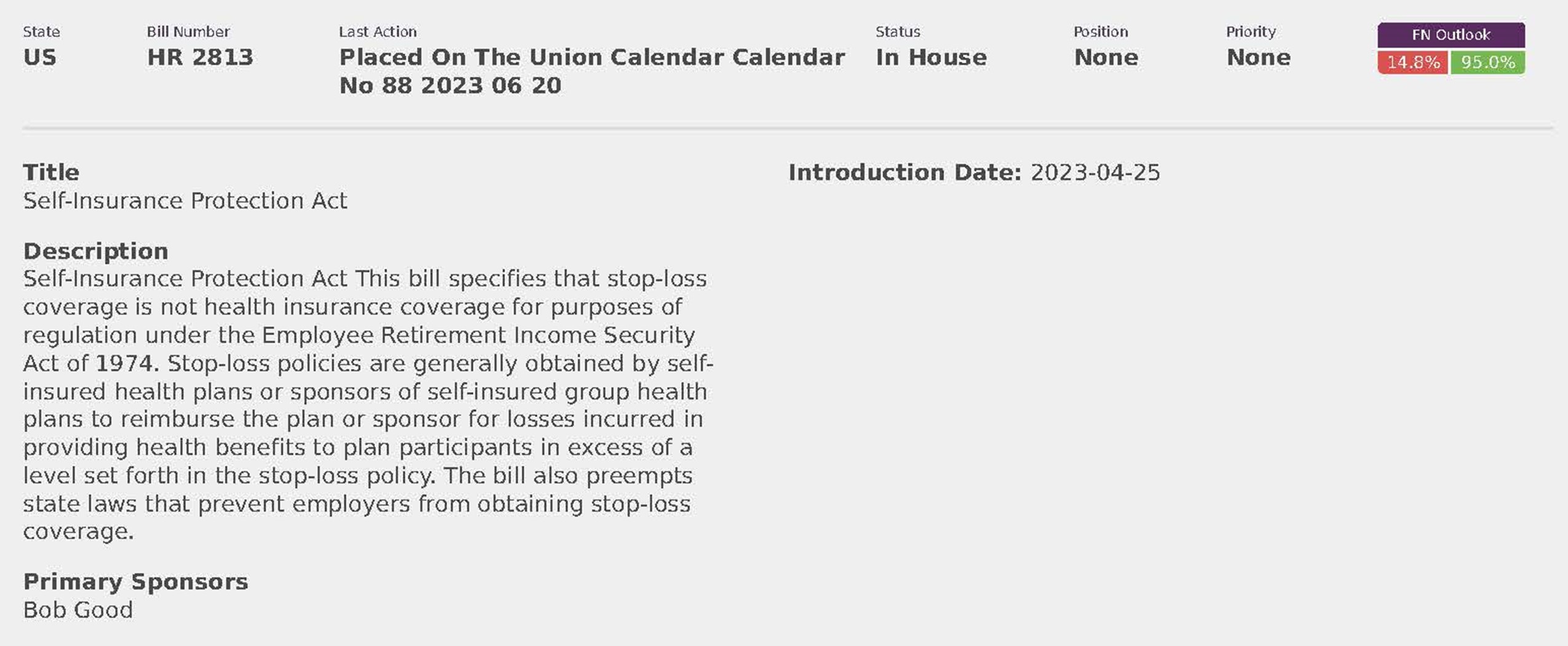

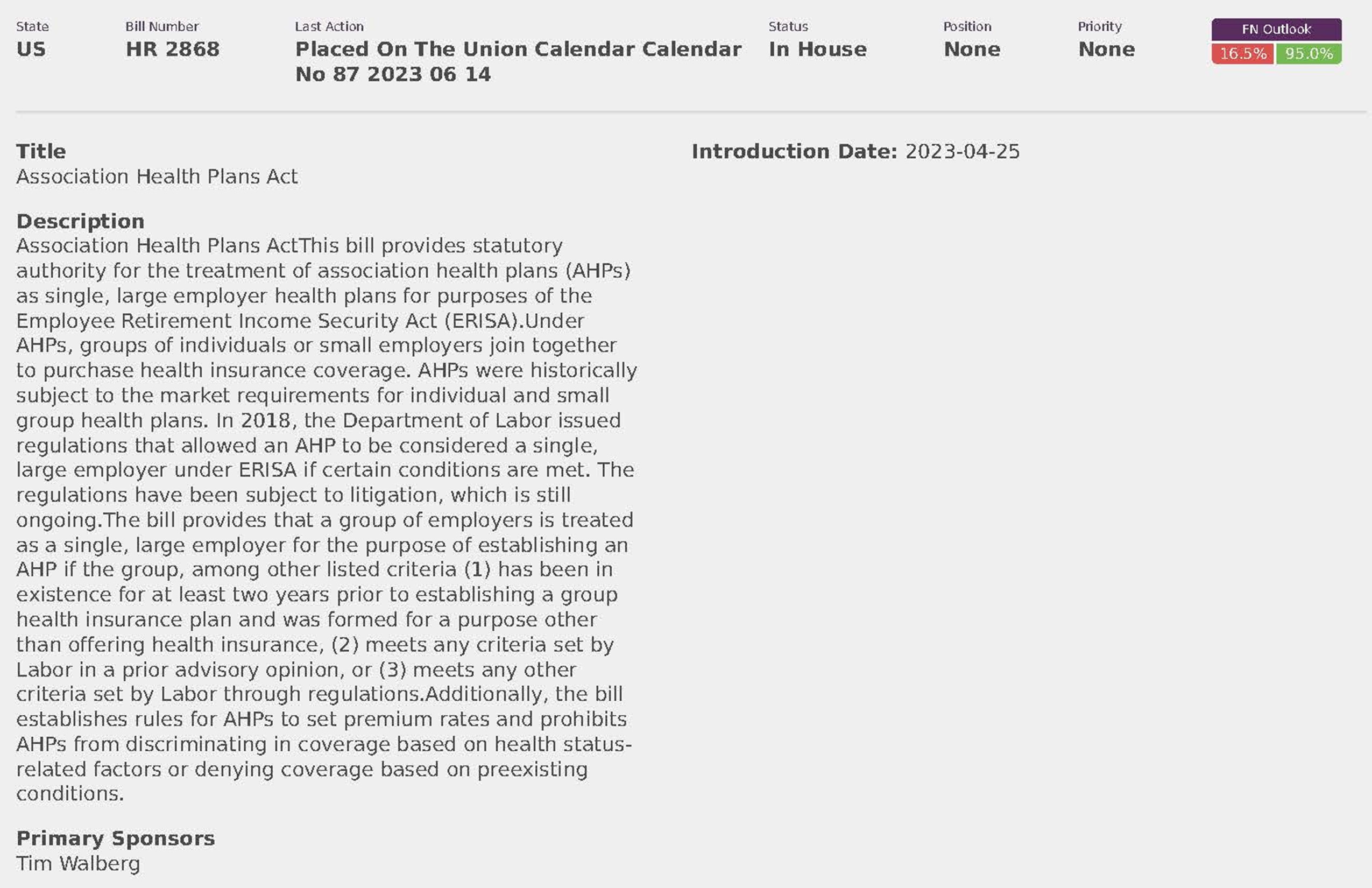

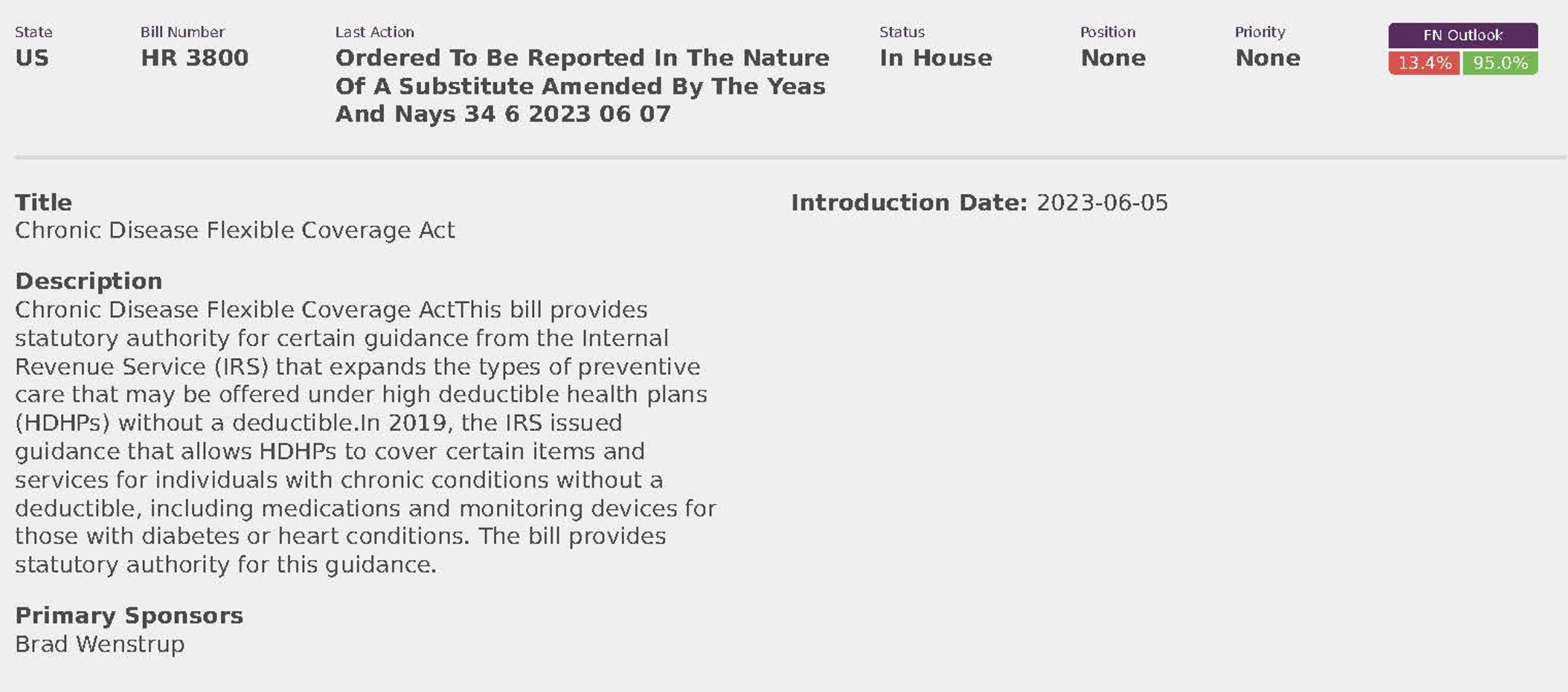

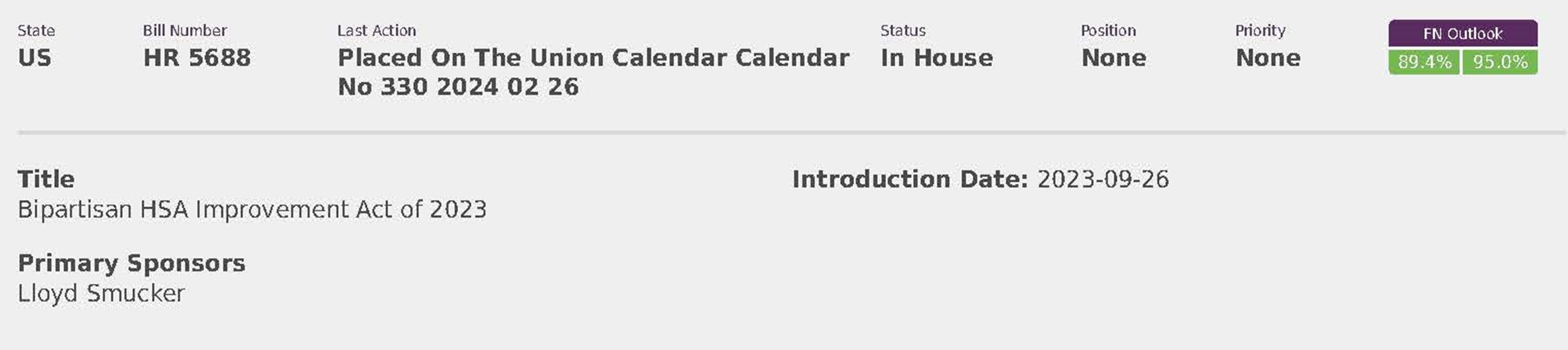

In July, Lobbyit tracked any relevant legislation and regulations that could impact NEA. Additionally, through meetings with numerous Congressional offices kept track of the conversations around ERISA plans, short term healthcare coverage, and any possible coming changes to employee-sponsored health plans.

Report on the Impact of the Supreme Court’s Loper Bright Decision on ERISA

Overview:

The Supreme Court’s decision in Loper Bright overruled the Chevron deference, fundamentally changing how courts interpret statutes. Under Chevron, courts deferred to reasonable agency interpretations of ambiguous statutes. Loper Bright mandates that courts, not agencies, determine the best reading of statutes, eliminating Chevron deference.

Key Points:

Chevron Deference Overruled:

Previously, courts used a two-step approach under Chevron to defer to agency interpretations if statutes were ambiguous. Loper Bright requires courts to interpret laws themselves, removing the deference previously given to agencies.

Impact on ERISA Regulations:

Statutory Regulations: Regulations explicitly directed by Congress to agencies, such as those under ERISA Section 4213(a)(2) regarding withdrawal liability, remain respected and unchanged by Loper Bright.

Interpretative Regulations: Courts will now scrutinize interpretative regulations for “reasoned decision making” under the APA but will not give them special deference. This affects regulations like those on plan forfeitures and Section 401(a)(9) distributions.

Legal Challenges and Statute of Limitations:

Corner Post v. Board of Governors: The Supreme Court clarified that challenges to agency regulations must be filed within six years of the injury, not the regulation’s enactment. This may encourage more challenges to agency actions under ERISA now that Chevron deference is eliminated.

Cases and Areas to Watch: ESG Investments: The DOL’s ESG rule, which permits fiduciaries to consider environmental, social, and governance factors in retirement plans, faces increased scrutiny without Chevron deference.

Use of Forfeitures: Litigation on the use of forfeited plan funds may see different interpretations without Chevron deference.

DOL’s Final Fiduciary Rule: Implementation of the DOL’s final fiduciary rule has been halted by courts, reflecting the increased judicial scrutiny post-Chevron.

Conclusion:

The Supreme Court’s Loper Bright decision significantly impacts how ERISA regulations are treated in court. Without Chevron deference, agencies like the DOL and PBGC will face greater judicial scrutiny, potentially leading to more legal challenges and changes in regulatory practices. Lobbyit will keep NEA informed about these developments and help consider their implications for compliance and regulatory strategy.

Regulatory Updates

Medicare Program; Calendar Year (CY) 2025 Home Health Prospective Payment System (HH PPS) Rate Update; HH Quality Reporting Program Requirements; HH Value-Based Purchasing Expanded Model Requirements; Home Intravenous Immune Globulin (IVIG) Items and Services Rate Update; and Other Medicare Policies

Summary:

This proposed rule would set forth routine updates to the Medicare home health payment rates; the payment rate for the disposable negative pressure wound therapy (dNPWT) devices; and the intravenous immune globulin (IVIG) items and services payment rate for CY 2025 in accordance with existing statutory and regulatory requirements. In addition, it proposes changes to the Home Health Quality Reporting Program (HH QRP) requirements and provides an update on potential approaches for integrating health equity in the Expanded Health Value Based Purchasing (HHVBP) Model. It also proposes a new standard for acceptance to service policy in the HH conditions of participation (CoPs) and includes requests for information (RFIs) soliciting input on permitting rehabilitative therapists to conduct the initial and comprehensive assessment and the factors that may influence the patient referral and intake processes. Lastly, it proposes updates to provider and supplier enrollment requirements and changes to the long-term care reporting requirements for acute respiratory illnesses.

Agency: Centers for Medicare & Medicaid Services (CMS), Department of Health and Human Services (HHS) Action: Proposed Rule

Dates: Comments due August 26, 2024

Health Data, Technology, and Interoperability: Patient Engagement, Information Sharing, and Public Health Interoperability

Summary: This proposed rule seeks to advance interoperability, improve transparency, and support the access, exchange, and use of electronic health information through proposals for: standards adoption; adoption of certification criteria to advance public health data exchange; expanded uses of certified application programming interfaces, such as for electronic prior authorization, patient access, care management, and care coordination; and information sharing under the information blocking regulations. It proposes to establish a new baseline version of the United States Core Data for Interoperability. The proposed rule would update the ONC Health IT Certification Program to enhance interoperability and optimize certification processes to reduce burden and costs. The proposed rule would also implement certain provisions related to the Trusted Exchange Framework and Common Agreement (TEFCA), which would support the reliability, privacy, security, and trust within TEFCA.

Agency: Office of the National Coordinator for Health Information Technology (ONC), Department of Health and Human Services (HHS) Action: Proposed Rule

Dates: To ensure consideration, comments must be received by 5 p.m. Eastern Time on the date 60 days after publication in the Federal Register.

Medicare and Medicaid Programs; CY 2025 Payment Policies under the Physician Fee Schedule and Other Changes to Part B Payment and Coverage Policies; Medicare Shared Savings Program Requirements; Medicare Prescription Drug Inflation Rebate Program; and Medicare Overpayments

Summary: This major proposed rule addresses: changes to the physician fee schedule (PFS); other changes to Medicare Part B payment policies to ensure that payment systems are updated to reflect changes in medical practice, relative value of services, and changes in the statute; codification of, and proposing policies for, the Medicare Prescription Drug Inflation Rebate Program under the Inflation Reduction Act of 2022; updates to the Medicare Diabetes Prevention Program expanded model; payment for dental services inextricably linked to specific covered medical services; updates to drugs and biological products paid under Part B including immunosuppressive drugs and clotting factors; Medicare Shared Savings Program requirements; updates to the Quality Payment Program; Medicare coverage of opioid use disorder services furnished by opioid treatment programs; updates to policies for Rural Health Clinics and Federally Qualified Health Centers; electronic prescribing for controlled substances for a covered Part D drug under a prescription drug plan or a Medicare Advantage Prescription Drug (MA-PD) plan under the Substance Use-Disorder Prevention that Promotes Opioid Recovery and Treatment for Patients and Communities Act (SUPPORT Act); update to the Ambulance Fee Schedule regulations; codification of the Inflation Reduction Act and Consolidated Appropriations Act, 2023 provisions; updates to Clinical Laboratory Fee Schedule regulations; updates to the diabetes payment structure and PHE flexibilities; expansion of colorectal cancer screening and Hepatitis B vaccine coverage and payment; establishing payment for drugs covered as additional preventive services; Medicare Parts A and B Overpayment Provisions of the Affordable Care Act.

Agency: CMS and HHS Action: Proposed Rule

Dates: Comments due September 9, 2024

Medicare and Medicaid Programs: Hospital Outpatient Prospective Payment and Ambulatory Surgical Center Payment Systems Summary: This proposed rule would revise the Medicare hospital Outpatient Prospective Payment System (OPPS) and the Medicare

Ambulatory Surgical Center (ASC) payment system for calendar year 2025 based on our continuing experience with these systems. In this proposed rule, we describe the changes to the amounts and factors used to determine the payment rates for Medicare services paid under the OPPS and those paid under the ASC payment system. Also, this proposed rule would update and refine the requirements for the Hospital Outpatient Quality Reporting Program, Rural Emergency Hospital Quality Reporting Program, Ambulatory Surgical Center Quality Reporting Program, and Hospital Inpatient Quality Reporting Program.

This proposed rule would request information on options being considered for future changes to the Overall Hospital Quality Star Rating methodology. The proposed rule would narrow the description of “custody” for purposes of Medicare’s no legal obligation to pay payment exclusion. The proposed rule would revise the eligibility requirements in the special enrollment period (SEP) for formerly incarcerated individuals to tie the eligibility for this SEP to the determination made by the Social Security Administration that they are no longer incarcerated for releases that occur on and after January 1, 2025. This rule also proposes to codify the requirement in the Consolidated Appropriations Act, 2023 (CAA, 2023) to provide 12 months of continuous eligibility to children under the age of 19 in Medicaid and CHIP, with limited exceptions. Further, this proposed rule would provide updates to the Conditions of Participation (CoPs) for hospitals and critical access hospitals (CAHs) in an effort to advance the health and safety of pregnant, birthing, and postpartum patients.

This rule proposes to separately pay IHS and tribal hospitals for high-cost drugs furnished in hospital outpatient departments through an add-on payment in addition to the AIR under the authorities used to calculate the AIR starting January 1, 2025. This rule also requests further information related to a Tribal Technical Advisory Group request to apply the Indian Health Service encounter rate to all outpatient tribal clinics. Finally, the proposed rule would provide exceptions to the Medicaid clinic services benefit four walls requirement for Indian Health Service and Tribal clinics, and, at state option, for behavioral health clinics and clinics located in rural areas.

Agency: Centers for Medicare & Medicaid Services (CMS), Department of Health and Human Services (HHS) Action: Proposed rule

Dates: To be assured consideration, comments must be received by September 9, 2024.

Medicare Program; Alternative Payment Model (APM) Incentive Payment Advisory for Clinicians-Request for Current Billing Information for Qualifying APM Participants

Summary: This advisory is to alert certain clinicians who are Qualifying APM participants (QPs) and have earned an Alternative Payment Model (APM) Incentive Payment that CMS does not have the current information needed to disburse the payment. This advisory provides information to QPs on how to update their Medicare billing information so that CMS can disburse APM Incentive Payments.

Agency: Centers for Medicare & Medicaid Services (CMS), Health and Human Services (HHS) Action: Payment advisory

Dates: July 17, 2024

Senate Appropriations Committee

Senate appropriators began their fiscal 2025 markup process by approving subcommittee allocations along partisan lines for the second consecutive year. The Democratic-controlled committee passed a $1.61 trillion slate for its twelve annual bills, excluding emergency spending and other adjustments to be added later. The partisan split indicates likely challenges in resolving election-year funding disputes.

Appropriations Chair Patty Murray (D-Wash.) and ranking member Susan Collins (R-Maine) agreed to include $34.5 billion in emergency spending beyond the budget caps from the previous debt limit law. Of this, $21 billion is allocated for defense programs and $13.5 billion for domestic and foreign aid. Additional nondefense spending adjustments from the previous debt limit deal will also be added, resulting in defense programs receiving a 3.4% increase, or nearly $30 billion, while nondefense programs will get at least $20 billion more than fiscal 2024, or a 2.7% increase. Murray criticized the 1% increase for defense and nondefense programs from the debt limit agreement as inadequate. In contrast, House Republicans’ bills propose minimal use of side agreement funds, cutting nondefense programs by 6-7% and providing a 1% increase for defense, which many Republicans find insufficient.

With spending allocations in hand, Senate appropriators approved their first three bills for fiscal 2025 on Thursday. The Military Construction-VA, Agriculture, and Legislative Branch bills all passed unanimously in committee. The Military Construction-VA bill supports a nearly $359.3 billion topline, slightly higher than the House’s $357.9 billion. Senate appropriators included about $1.35 billion more for military construction projects, focusing on home-state “congressionally directed spending.”

The Senate bill avoided many partisan policy riders that led to a White House veto threat on the House version. The bipartisan Senate process emphasized supporting veterans’ healthcare and critical accounts. Ranking member Susan Collins expressed concern about the VA’s reliance on carryover balances but praised the bill’s investments in military infrastructure and veterans’ support. The VA budget request heavily draws from unspent funds from prior years, necessitating a significant increase in discretionary funding by fiscal 2026.

House Appropriations Breakdown

The House appropriations process is facing significant challenges due to partisan disputes. Plans to pass four of the 12 annual spending bills were halted due to concerns over the Agriculture (HR 9027) and Financial Services (HR 8773) bills. Only the less contentious Interior- Environment (HR 8998) and Energy-Water (HR 8997) bills will be considered this week. If these two pass, the House will have approved half of the annual appropriations bills, covering nearly 75% of the next year’s $1.6 trillion funding. However, conservative and moderate disagreements on spending levels and policy provisions have complicated the passage of the remaining bills. House leaders are considering canceling votes next week, with potential plans for additional legislative items remaining uncertain.

President Joe Biden has indicated that the GOP bills will not become law, issuing veto threats against the Agriculture, Energy-Water, Financial Services, and Interior-Environment bills. The House Rules Committee approved 65 amendments for the Energy-Water bill debate and 97 for the Interior-Environment bill. Highlights include amendments to ban funding for Energy Department research into lab-grown meat, cut the Energy Secretary’s salary, bar funding for drag show performances at the Smithsonian, and restrict funding for the U.S. Board on Geographic Names. This board has been criticized by conservatives for renaming derogatory community names, a move defended by Interior Secretary Deb Haaland. The Energy-Water bill is scheduled for consideration first on Tuesday, followed by the Interior-Environment bill.

Bills by Issue

National Employers Association (8)