Work on the Hill

As February comes to an end, Republican leadership in the House and Senate continue to move forward with their plans to pursue their tax and spending priorities using the budget reconciliation process. The first step in that process is for Congress to pass a budget resolution with instructions for Congressional committees to approve policy changes that achieve the spending and revenue targets in the budget.

On February 13, the House Budget Committee voted to approve a budget resolution in a party line vote (21-16). The resolution directs the House Ways & Means Committee to produce tax legislation that increases the deficit by no more than $4.5 trillion. However, that number may be reduced if the other authorizing committees cannot generate savings of at least $2 trillion. Overall, the plan allows for an increase of up to $3.3 trillion in the deficit over a decade.

Importantly, the current continuing resolution funding much of the federal government expires on March 14, 2025. House and Senate appropriators are actively discussing options, and it is likely that Congress will have to consider another continuing resolution to fund the government on a temporary basis while lawmakers work on a closing spending solution for the 2025 fiscal year. In addition, Congress will need to consider legislation suspending the debt limit sometime this year, either part of budget reconciliation legislation or otherwise.

Legislative Update

HR 379: Healthcare Freedom and Choice Act

Summary: This bill reinstates individuals’ access to short-term, limited-duration insurance (STLDI) plans for up to 36 months, an increase from the Biden Administration’s rule limiting access to 4 months. STLDI provides Americans with affordable, temporary health coverage options. For millions of Americans, STLDI is the only option for filling a gap in health insurance coverage.

Sponsor: Rep. Buddy Carter (R-GA)

Legislative Preview: HHS Cuts

The Trump administration has defended the recent dismissal of 3,600 probationary employees at the Department of Health and Human Services (HHS) as a more “surgical” approach compared to other federal agency cuts. Despite widespread concern and criticism over mass firings, officials stressed that employees in critical areas, such as CDC scientists, frontline health workers, and FDA personnel, were exempt from the cuts.

These layoffs are part of a broader strategy to reduce the size of the federal workforce, but with a focus on protecting essential functions. The cuts are expected to save HHS over $600 million annually, but they have sparked controversy, with Democrats and some Republicans expressing concern over the process’s lack of transparency and the anxiety it has caused among employees. Officials emphasized that the cuts were intended to streamline operations while ensuring that key health functions, including emergency preparedness and public health response, were not compromised.

The administration’s message contrasts with the more aggressive cuts seen in other departments, signaling a more cautious approach within HHS, especially as the new HHS Secretary, Robert F. Kennedy Jr., begins his tenure.

Health Agencies and Workforce Cuts

The Trump administration continues a significant reduction of the federal workforce within the Department of Health and Human Services (HHS), notably impacting critical health agencies like the Food and Drug Administration (FDA), Centers for Medicare and Medicaid Services (CMS), and the Administration for Strategic Preparedness and Response (ASPR). These cuts, part of a broader plan to eliminate roughly 3,600 probationary employees across the department, raise concerns about the potential damage to public health programs and the ability to respond to health threats.

A key priority for the administration is to streamline and reduce the workforce in non-essential areas, though these cuts have sparked criticism for affecting core public health functions. Lawmakers and health experts warn that this could impair efforts related to Medicare and Medicaid improvements, medical device approvals, and emergency preparedness. The chaotic and sometimes opaque nature of the firings has left employees and agency leaders uncertain about the future direction of these agencies.

As HHS faces these staff reductions, it will be important to monitor the potential long-term consequences for public health initiatives and the department’s ability to meet health challenges. There are also concerns about how these workforce changes align with new HHS Secretary Robert F. Kennedy Jr.’s policy priorities. With the workforce cuts continuing, clarity on future staffing decisions and health program impacts will be crucial for understanding how the administration’s goals will unfold.

Issues to be addressed by RFK

The Department of Health and Human Services (HHS) faces major policy shifts under new leadership, with significant implications for healthcare funding, pharmaceutical regulation, and public health programs. The administration’s approach to these issues will shape access to care, agency priorities, and federal health spending.

Proposed changes include restructuring the National Institutes of Health (NIH) and the Food and Drug Administration (FDA), with potential workforce reductions. While aimed at cutting costs and streamlining operations, downsizing could impact medical research funding and regulatory oversight.

A key decision ahead is whether to expand Medicare coverage for weight-loss drugs, a move that could significantly increase federal spending. Broader efforts to regulate prescription drug advertising and lower costs are expected, though the administration must balance cost-cutting measures with industry concerns. Revisions to federal food assistance programs, including restrictions on certain subsidized products, are being considered as part of an effort to address obesity and chronic disease. Any changes to dietary guidelines or food regulations could face legal challenges and industry pushback.

Upcoming policy decisions will determine the scope of changes to healthcare access, public health initiatives, and federal spending. With regulatory reviews and funding adjustments on the horizon, the administration’s approach will have lasting effects on the healthcare system.

CMS Cuts Funding for ACA Navigators

The Centers for Medicare & Medicaid Services (CMS) has announced a significant reduction in funding for the nonprofit navigators who assist individuals in signing up for Obamacare insurance. The Trump administration will decrease navigator funding from $98 million in 2024 to just $10 million for the 2026 coverage year. This move mirrors a similar decision made during the first Trump administration, which also slashed funding for navigators to $10 million.

CMS justifies the funding reduction by citing the relatively low number of people navigators enrolled in Obamacare: only 92,000 consumers, or 0.6% of total enrollments, during the most recent open enrollment period. However, navigator advocates argue that their role extends beyond enrolling people in insurance exchanges. Navigators also assist individuals with Medicaid eligibility and provide valuable information about available health coverage.

This funding cut is part of broader efforts by the Trump administration to reduce federal spending on ACA outreach and enrollment. Advocates point to past research showing that cuts to navigator funding, marketing, and outreach have led to drops in enrollment. In 2020, enrollment in ACA coverage decreased by 1.27 million people from 2016, a period before these cuts were enacted.

While CMS argues that the savings from reduced navigator funding will be passed on to consumers in the form of lower premiums, this move has drawn praise from Republicans, including Rep. Brett Guthrie (R-Ky.), who supports the reduction in spending. However, this change comes at a critical time, as the Biden administration’s efforts to expand coverage through enhanced tax credits have driven significant growth in Obamacare enrollment, reaching nearly 24 million individuals for the 2025 plan year. These tax credits, however, will expire at the end of 2025 unless Congress acts to extend them.

House Republicans’ Budget

House Republicans have advanced a budget resolution that sets the stage for major domestic reforms, including tax cuts, border security, defense spending, and energy policy, in alignment with President Donald Trump’s agenda. The resolution, approved by the House Budget Committee in a party-line vote, provides the fiscal framework for a large, single-package bill aimed at sidestepping the Senate filibuster.

A key amendment, negotiated with fiscal conservatives, requires Republicans to make $2 trillion in spending cuts in exchange for tax cuts. This may limit the scope of tax cuts or deepen cuts to mandatory programs, such as safety net benefits, potentially alienating swing-district Republicans. The resolution sets up the possibility of tax cuts that could increase the deficit by $4.5 trillion, while requiring cuts to mandatory spending programs to reduce the deficit by $1.5 trillion over the next decade.

Republican leaders are hoping to move the resolution to a full House vote by the end of February, while Senate Republicans, led by Budget Chair Lindsey Graham, are pushing for a “two-track” approach, splitting the tax cuts from other policy areas. The final package will require both chambers to approve identical budget measures to unlock reconciliation powers and avoid a filibuster, allowing Republicans to pass legislation without Democratic input.

Democrats have heavily criticized the resolution for its potential to increase the deficit by $3.3 trillion over the next decade and its proposed cuts to social programs. The House GOP now faces the challenge of uniting around a strategy to ensure swift passage through both chambers.

Prescription Drug Costs

The House Energy and Commerce Committee is signaling renewed bipartisan interest in overhauling pharmacy benefit manager (PBM) regulations to lower prescription drug costs. A subcommittee hearing on PBM reform is scheduled for Feb. 26, although the date may shift.

In the previous Congress, lawmakers reached a bipartisan agreement to regulate PBMs—intermediaries that negotiate drug prices on behalf of insurers and employers. The deal was initially set to pass as part of a broader government funding bill but stalled after opposition from President Donald Trump and Elon Musk.

With full Republican control of Washington, PBM reform remains one of the few bipartisan health policy areas with potential for progress. However, Republicans may seek to use the regulations as a cost-saving measure to finance broader legislative priorities, with the Energy and Commerce Committee possibly needing to find up to $880 billion in savings.

The inclusion of PBM reforms in a budget reconciliation bill is uncertain due to procedural rules and varying projections of potential savings. Democrats have cautioned against using the measure as a budget offset, warning it could undermine further bipartisan cooperation.

There is also ongoing debate about the effectiveness of additional PBM regulations. The pharmaceutical industry argues PBMs drive up drug costs, while PBMs counter that new rules would increase prices for consumers. The outcome of these negotiations will determine whether a long-awaited overhaul of drug pricing intermediaries moves forward.

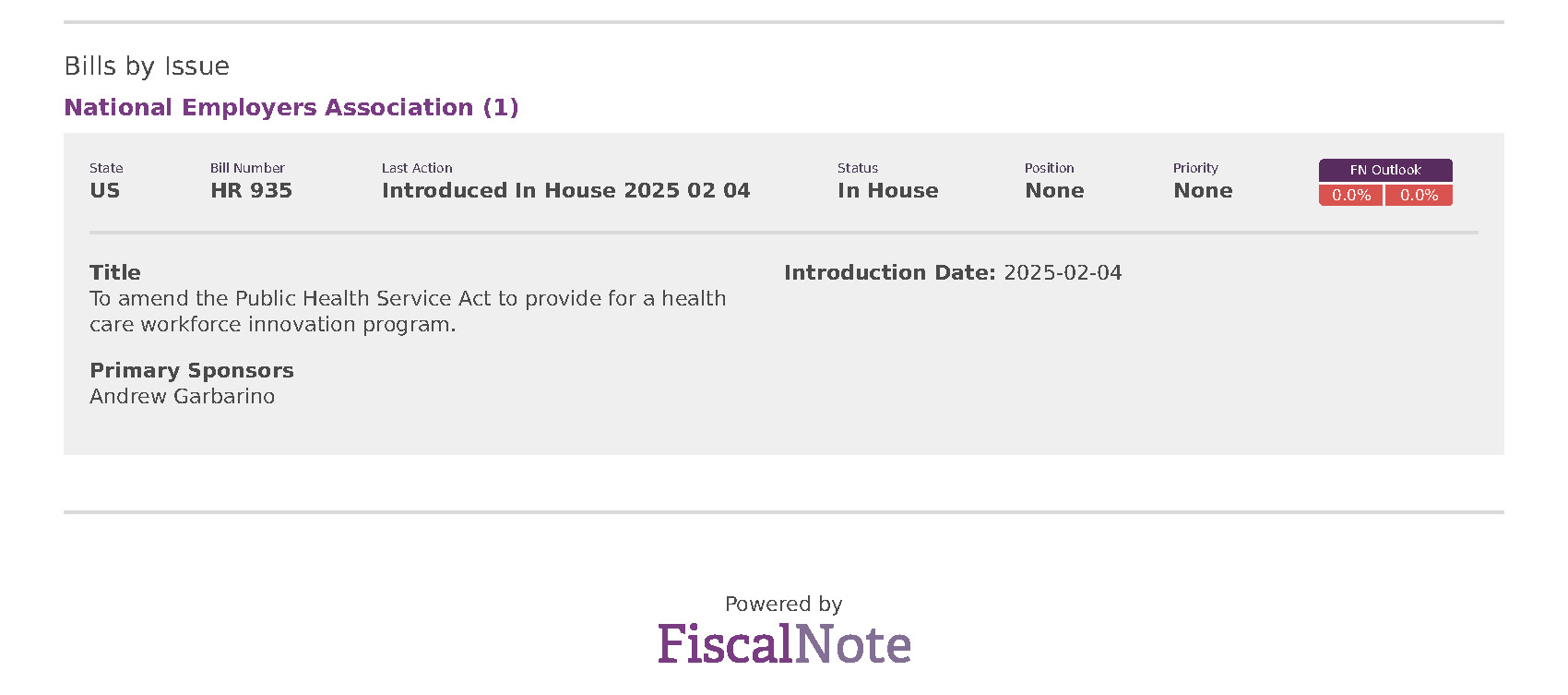

Bills by Issue

National Employers Association (1)